INDUSTRIAL ENGINEERING APPLICATIONS IN FINANCIAL ASSET MANAGEMENT:AN ILLUSTRATION

AN ILLUSTRATION

The Efficient Frontier

To illustrate the essence of the asset-allocation problem, I begin with a simple example that includes the following assets: U.S. stocks, international stocks, U.S. bonds, international bonds, and cash. This constitutes a broad asset mix typical of that used by many professional managers. Expected returns are 11.0%, 12.6%, 6.0%, 6.9%, and 5.0%, respectively. The expected standard deviations (risk) of these returns are 12.5%, 14.7%, 4.3%, 7.8%, and 0.0%. Note that the standard deviation of cash returns is zero because this asset is presumed to consist of riskless U.S. Treasury securities. The correlation matrix for asset returns is:

Optimum portfolios are obtained by selecting the asset weights that maximize portfolio return for a specific portfolio risk. The problem constraints are that (1) the portfolio return is a linear combi- nation of the separate asset returns, (2) portfolio variance is a quadratic combination of weights, asset risks, and asset correlations, and (3) all weights are positive and sum to one.

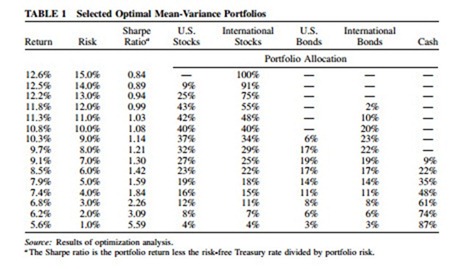

The results of producing MV portfolios are presented in Table 1. The corresponding efficient frontier is shown in Figure 1. The allocations obtained are typical for analyses of this type. That is, to obtain higher portfolio returns, the investor must take on more risk. This is accomplished by weighting equities more heavily. The most conservative portfolios have both low returns and low risk. They consist primarily of cash and bonds. For moderate levels of risk, investors should blend stocks and bonds together in more equal proportions. In addition, note that the most risky portfolios skew to higher weights for international equities, which are more risky than U.S. stocks.

It should be obvious that the production of MV portfolios is not extraordinarily input intensive. Efficient frontiers for five asset portfolios require only five predicted returns, five standard deviations, and a five-by-five symmetrical matrix of correlation coefficients. Yet the process yields indispensable information that allows investors to select suitable portfolios.

Investor Risk Preferences

Once the efficient frontier is established, the issue of investor risk preferences must be addressed. Individuals exhibit markedly different attitudes towards risk. Some are extremely risk averse, toler- ating nothing but near certainty in life. Others relish risk taking. Most are somewhere between these two extremes.

Risk attitudes depend on personality, life experience, wealth, and other socioeconomic factors. By default, extremely risk-averse investors are not interested in building wealth via asset accumu- lation, because they are unwilling to tolerate the risk necessary to obtain high returns. The opposite is true for adventurous souls ready to gamble for large payoffs. In this regard, ‘‘old-money’’ investors

are usually more risk averse than ‘‘new-money’’ investors. They require portfolios heavily weighted in conservative assets. New-money investors are comfortable with inherently risky equities (Figure 2). Age often plays an important role. Older investors are commonly more risk averse because they are either retired or close to retirement and dissaving (Figure 3).

How does one ascertain risk tolerance to guarantee a relevant portfolio is matched to the investor’s needs? There are a number of ways. One is to estimate the risk-aversion parameter based on the investor’s response to a battery of questions designed to trace out their return preferences with different payoff probabilities.

Some financial managers simply use personal knowledge of the investor to deduce risk tolerance. For example, if an investor with a $10 million portfolio is distraught if the portfolio’s value plunges 20% in a year, he or she is not a candidate for an all-equity portfolio. Yet another approach used by some managers is to work backwards and determine the risk necessary for the investor to reach specific wealth-accumulation goals.

Comments

Post a Comment